Restructuring to Manage $75,000 ATO Debt

Background

A small business faced a significant challenge with $75,000 in debt owed to the Australian Taxation Office (ATO). The business also faced additional debts and financial pressures, including rent arrears to their lessor, making the situation more precarious. Without intervention, the business risked involuntary administration, which could jeopardise its future operations.

Challenge

The primary issue was the debt to the ATO, a substantial burden that the business could not repay immediately in its entirety. The risk of involuntary administration loomed if a viable solution was not found.

Restructuring Strategy

The business focused solely on addressing the ATO debt to avoid complications with other creditors. They utilised the Small Business Restructuring process under the Australian Corporations Act 2001:

- Strategic Offer: The business appointed a Small Business Restructuring (SBR) Practitioner and approached the ATO with a proposal to settle the debt. The Act allows for proposals submitted to creditors to be paid back on terms of up to three years.

- Time to consider: Generally, once an SBR Practitioner has been appointed, the ATO will cease further action until the plan has been voted on. The debts of the business are crystalised on the day of appointment, and the process, once an SBR Practitioner is appointed, takes around 35 days.

- Maintaining control: Under a Small Business Restructure, day to day management of the business stays with the directors.

Outcome

- Resolve the Debt: The confidential agreement provided the business with immediate financial relief.

- Continue Operations: By resolving the ATO debt, the business avoided involuntary administration and was able to focus on maintaining operations and managing other financial responsibilities.

- Retain Employment: Importantly, 15+ employees were able to keep their jobs, which not only preserved their livelihoods but also the income tax generated from their wages.

- Long-Term Viability: The business remains a taxpayer and is contributing to the economy in the long term.

At the Tax Institute’s Tax Summit 2023, Deputy ATO Commissioner Vivek Chaudhary stated, “92% of restructuring plans received since 2021 have been accepted by creditors. To date, the ATO has supported most restructuring plans, voting in favour of 91% of them. Each plan is assessed on its merits and our voting history shows our commitment to supporting businesses through restructuring.”

Restructuring may be possible upon receiving a director’s notice, but only if lodged before the expiry notice.

The ASIC website contains more information: Restructuring and the restructuring plan | ASIC

To discuss your situation, and get connected with people that can help, reach out to our Assistance team.

Small Business Case Studies

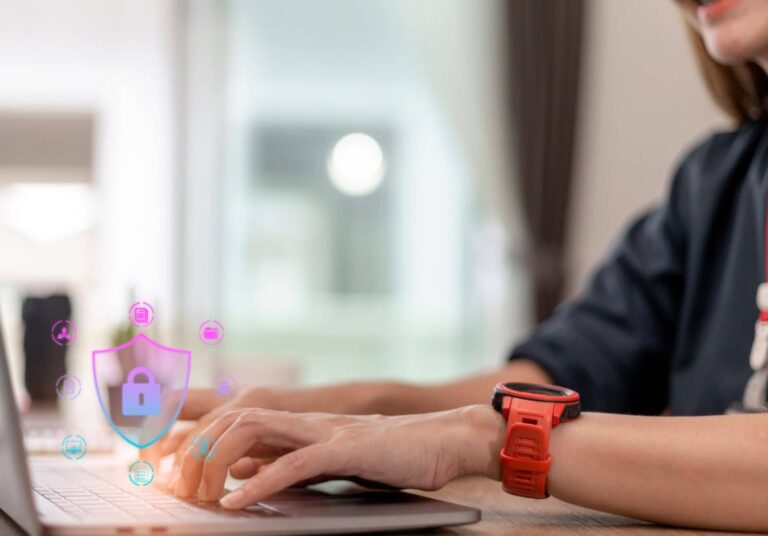

Cyberattacks on small business

Cyberattacks are common. According to the latest report from the Australian Signals Directorate, one occurs every six minutes, with the financial losses for small businesses averaging around $49,000. But financial loss isn’t the only concern – there’s also the potential reputational damage with your customers and suppliers.

Seeking Legal Advice: Your Compass in Dispute Resolution

Disagreements and legal disputes are often fraught with intense emotions and complex legalities. Understanding where you stand legally is crucial. It equips you with the knowledge and confidence to navigate the dispute resolution process successfully, whether through direct negotiation or via mediation.

Retail Shop Lease Forms for Queensland Retail Tenants and Landlords

A commercial lease breach notice is a formal notification from a property owner that the tenant has failed to comply with terms of the lease agreement.