The report provides key data, facts, and insights relevant to Queensland small businesses.

Released in September 2023, the report can be used by small businesses to inform decision-making and aims to raise public awareness about small business challenges.

Australia has shown strength and resilience, quickly moving past the COVID-19 pandemic economically.

The country is now experiencing high inflation and high interest rates that could curb economic growth in the short term; however, with Queensland experiencing strong population growth and a rebounding tourism sector, there are many opportunities for small businesses.

Dominique Lamb – Small Business Commissioner

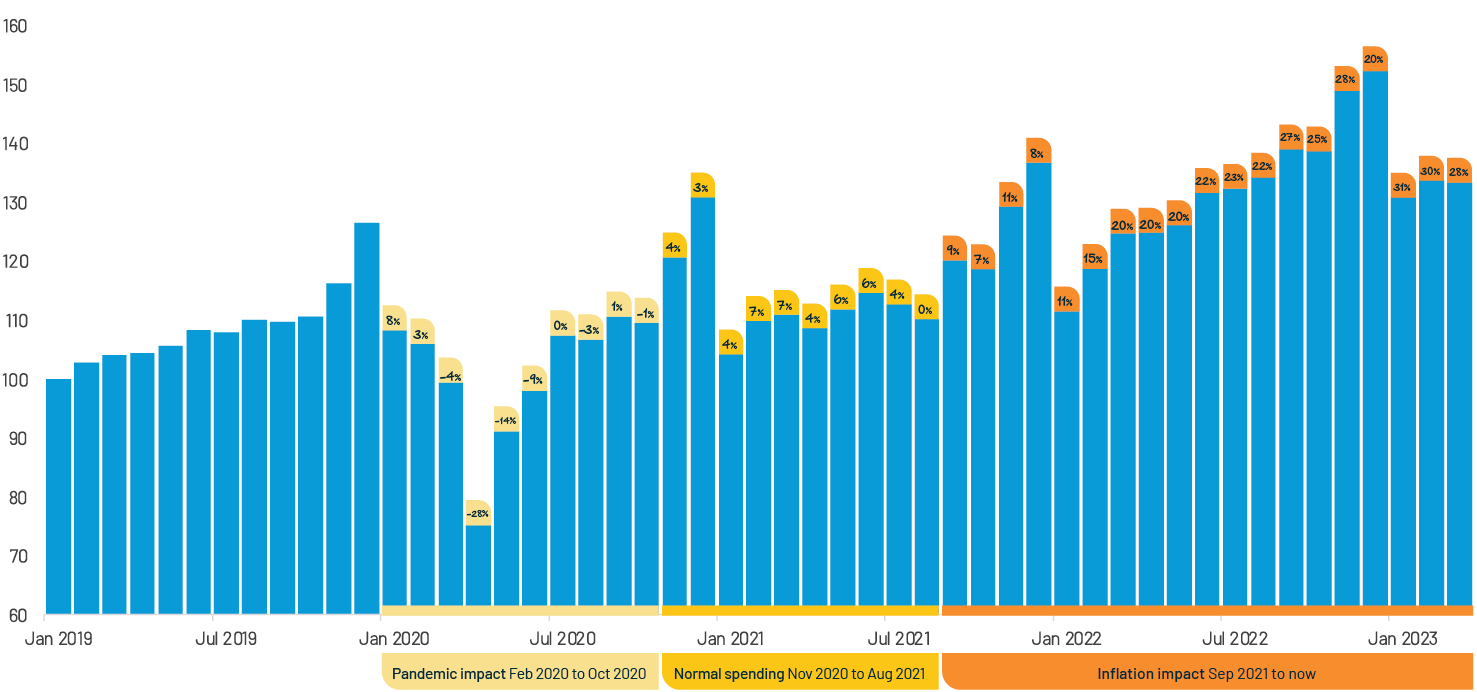

The last three years can be viewed in three distinct spending periods:

The pandemic had a severe but short-lived impact on household spending, with normal levels of spending quickly resumed after the initial shock. The challenge now is the impact of inflation and interest rate rises, and small businesses need to be aware that consumer spending at these levels is not sustainable.

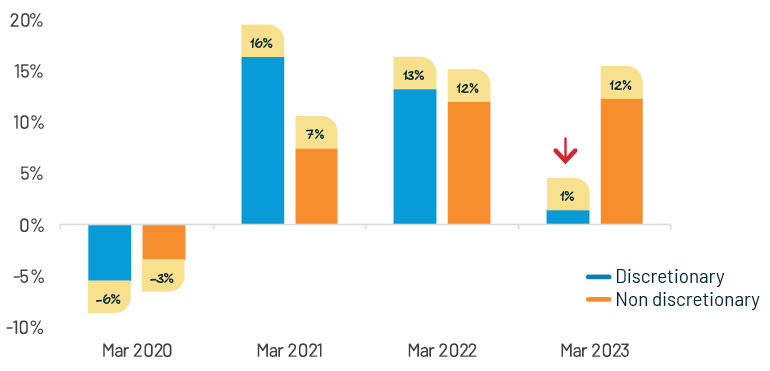

One of the key indicators of slowing consumer spend across Australia is discretionary spend, which has stalled.

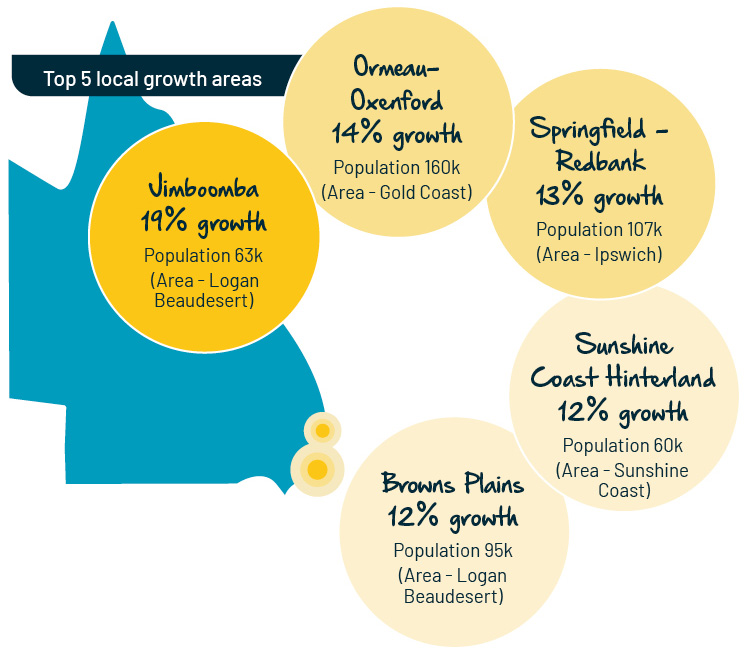

People have been moving from all over Australia to South-East Queensland over the last few years. Three of the top five local growth areas are in the greater Brisbane area. By following Queensland’s growing population and popularity, small businesses can target their efforts to areas of the state where the population is booming.

After the pandemic, the number of small businesses operating in Queensland increased in 18 of the 19 industries. On average, the number of small businesses has increased by 9.5% across our state, which surpasses national small business growth of 7%. This is not just from new businesses starting up, but from an increased survival rate (up to 64.3%) for established businesses, due to high levels of consumer spending, and government support throughout the pandemic.

Conditions have been strong for small businesses, and profitability is up. Pressure points like wages and rising interest rates need to be understood and managed, so that small businesses can maintain their margins and strength.

Small businesses can use benchmarking as a guide to determine how well they are performing, and these two simple key ratios can help them improve efficiency: profit margin and wage ratios.

For example, the real estate industry averages a 54% profit margin, while the resource and input-heavy wholesale trade industry, and the accommodation and food industry both sit at a profit margin of only 7%.

Some industries like education and professional services are wage heavy and more likely to be impacted by wage pressure. Arts and recreation have seen a 27% increase in wage ratio as wage dynamics have changed over the last four years.

We welcome you to read the report, share it with small businesses and across your networks.

To download the full report, fill in the form below

© The State of Queensland 1995–2022, Queensland Government